Know and Maximize Your Net Proceeds

by Michael Schroeder

Learn the basics of how net proceeds are calculated so you can better understand how it influences a decision to sell.

Receiving a high purchase price for your business is a great first step, but maximizing the net proceeds is ultimately most important. Unfortunately, purchase price does not equal net proceeds and could result in adjusted expectations. Understanding a seller’s net proceeds can be complex and should be fully understood prior to signing any Letter of Intent (“LOI”) or definitive agreement. Deals with similar purchase prices don’t necessarily mean similar net proceeds. Having an experienced team analyzing and negotiating on behalf of a seller will avoid surprises down the road and maximize what is available in the end. This article highlights some of the primary concepts for consideration when exploring a potential sale and how it impacts net proceeds.By definition, a seller’s net proceeds are the final cash consideration received after deducting for all deal obligations, expenses and taxes.

ENTERPRISE VALUE

Generally, the transaction value or purchase price would be stated as enterprise value, which is the “market value” of a business and assumes the business will transact on a “cash-free, debt-free” basis. So, while deal discussions generally commence and focus around an initial transaction value, the net proceeds can be vastly different from seller to seller based on capital structures, amongst other factors. Cash and debt or debt-like obligations are viewed as non-operating assets and liabilities and will likely include several other accounts deemed to be non-operating in nature (e.g. related party receivables, accrued interest, customer deposits) that will not transfer to a buyer. As such, a seller that is in a better net debt (debt less cash) position would realize greater net proceeds at close before taxes and other considerations.

DEAL STRUCTURE

In a transaction, the seller will either be selling its stock/equity or its assets. This is a very important distinction as it could have very different tax implications to the seller and also the buyer post-transaction. Assuming similar purchase prices, a stock transaction is generally more favorable for a seller due to recognizing the gains as long-term capital gains vs. the higher taxation of ordinary income experienced in an asset sale. In an asset sale, a buyer can and often seeks the benefit of additional depreciation and amortization from being able to write-up the value of assets, which is a disadvantage to a seller for tax purposes. Whether negotiating the structure itself or the value of the fixed assets, each of these components can have a material impact on net proceeds. Having an experienced tax accountant with M&A experience engaged early in a sale process will allow for maximum transparency and offer advisors insights and advantages in negotiations and what is the most advantageous structure to pursue. Additionally, a stock transaction or 338(h)10 election could be beneficial from a transition perspective.

DEFERRED PAYMENT

Depending on several business variables and how competitive is the sales process, the purchase price could include some form of deferred payment (e.g. seller financing and/or earnouts). While short-term escrow holdbacks are very common to cover potential warranty issues, any component of the purchase price that is not cash at close requires some level of judgment about the likelihood of receiving future payment. While escrow holdback periods are generally 18 months or less, seller financing or earnout payments could extend to 36 months or beyond. Making judgement calls on the likelihood of these payments becomes increasingly difficult as the seller would most likely lose majority control of the business and may no longer be involved on a day-to-day basis. A benefit of a competitive sale process led by an investment bank with negotiating leverage is that the seller could most likely drive a deal that maximizes cash at close.

NET WORKING CAPITAL

In a cash-free, debt-free transaction valued based on a stream of earnings and future cash flows, there will be an expectation for the seller to deliver a “normal” or “target” level of net working capital (“NWC”). Generally, the purchase price will be increased or decreased dollar-for-dollar for the amount of NWC delivered at closing less the agreed upon target, which is often settled 60 to 90 days post-closing. This is often one of the most negotiated items in a transaction and requires extensive analysis and negotiating efforts to best position the seller.

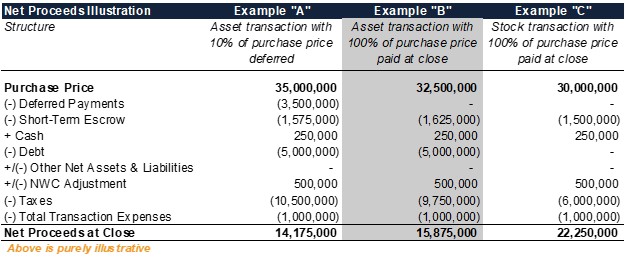

EXAMPLES OF NET PROCEEDS AT CLOSING

The following table is meant to provide a simple illustration of how businesses can have varying net proceeds outcomes on the day of closing resulting from the above discussion topics:

CONCLUSION

Beyond maximizing purchase price, an experienced M&A advisor maximizes net proceeds by being able to leverage years of deal experience and negotiation skills. Understanding and maximizing net proceeds (and mitigating future risk) goes well-beyond the items covered in this article and working with the right team can ensure this increasingly complex process is navigated successfully.

For more information or to better understand your options related to transitioning your business, please contact Mike Schroeder, Vice President, at ms@taureaugroup.com or any member of the Taureau Group team at 414-465-5555.