Hot M&A Run in Tech & Tech-Services Continues

by Andrew Sannes

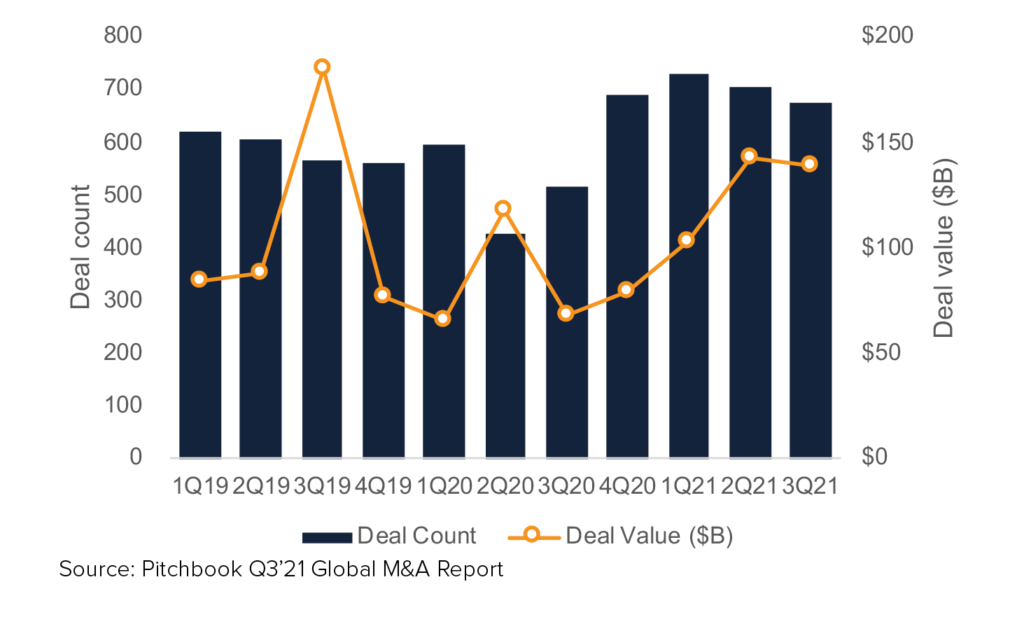

Taureau Group explores a variety of market perspectives in the technology sector, including what’s likely behind recent mergers and acquisitions, related trends in the market, and what to expect as we approach 2022. The hot M&A run in tech and tech-services continued through Q3’21. There were over 2,000 tech, media and telecom (TMT) deals with total deal value over $240 billion, with the lion’s share of deals (75%) and deal value coming from the tech segment of TMT. The record setting M&A pace in this sector is fueled in part by the following:

- Companies continue to refine and retool their technologies and accelerate digital transformation.

- Continued adoption of the remote workforce, telehealth and other effects of the COVID-19 pandemic.

- Data analytics is being utilized to a greater extent by sellers to sell a more compelling story to buyers to cash in on the high valuation undercurrents in the marketplace.

- The topic of environmental, social and governance (ESG) matters continue to be of great concern and priority for many executives and investors.

- An abundance of available capital and low interest rates persists, driving buyers’ acquisition hunger and the competitive processes driving valuation encourages sellers’ motivation to seek an exit or take on an investment partner.

- The technology sector continues to be affected by the global supply-chain disruptions.

RECENT EXAMPLES OF IT AND TECH-ENABLED DEALS

- Nextpoint, the industry leader in cloud-based eDiscovery and Litigation support software, acquired WarRoom from LaunchPad Lab, a Chicago-based software development agency.

- Gemspring Capital, a middle-market private equity firm, announced that an affiliate acquired a majority interest in AINS Inc., a provider of case management software and IT services, primarily for government customers.

- The Riverside Company invested in Halski Systems as an add-on investment to Riverside’s platform, Logically, a leading provider of Managed IT Services.

- HelpSystems acquired Digital Guardian, the industry’s only SaaS provider of data loss prevention (DLP) solutions for large and mid-sized organizations.

- Periscope Equity invested in Praecipio Consulting, a leading IT services and business process management consulting firm based in Austin, TX.

- Summit Hosting, a provider of dedicated cloud hosting services for accounting and other business software applications for small and medium-sized businesses, partnered with Silver Oak Services Partners in a recapitalization of the business.

- Pamlico Capital, a private equity firm based in Charlotte, North Carolina, announced a strategic growth investment in AVANT, a platform for IT decision-making and the nation’s premier distributor for next generation technology.

- HelpSystems acquired PhishLabs, a leading cyber threat intelligence company that protects organizations from attacks on their brands, employees, and digital assets.

- Paradigm, a provider of practice management software and integrated payments to the legal industry, announced a strategic growth investment from Francisco Partners, a leading global investment firm. Paradigm was formed by ASG, a software platform company backed by Alpine investors, a people-driven private equity firm.

- Confluence Technologies, Inc., a global technology solutions provider helping the investment management industry solve complex investment data challenges, acquired Compliance Solutions Strategies, a global provider of cloud-based regulatory software solutions.

- Togetherwork, a portfolio company of GI Manager, acquired Protech Associates, the leading provider of Association Software built for the Microsoft Dynamics 365 + platform.

- eDiscovery technology leader CloudNine acquired ESI Analyst, the emerging standard for modern file types such as mobile, chat, social media, text, computer activity, financial data, and more.

- Centrilogic, a global IT transformation solutions provider, acquired 3RP, a leading provider of managed services for Oracle Cloud Infrastructure (OCI), Oracle Applications, and Databases.

- VSS Capital Partners, a private investment firm investing in the healthcare, information, business services and education industries, sold its portfolio company, Coretelligent, LLC, to Norwest Equity Partners.

TECHNOLOGY DEAL VOLUME AND VALUE

TECHNOLOGY CONNECTIONS TO PROVIDE INNOVATIVE FINANCIAL SOLUTIONS

We’ve proudly served a number of market segments within the technology industry, including:

- IT Consulting Services

- Cloud Software & Services

- Security/Compliance

- Software-as-a-Service (“SaaS”)

- Internet & Digital Media

- E-Commerce

- Business Intelligence

- Managed Services

- Transaction Processing

- Mobile/Wireless

- Internet of Thing/Machine to Machine

- Telecommunications

In today’s fast-paced and growing technological world, it is more important than ever to have advisors who are at the forefront of the industry. Taureau Group understands the unique needs of companies looking to capitalize on change within the highly sophisticated and integrated technology industry, whether it’s cybersecurity, digital transformation, or other information technology services.

Our principals work alongside company owners and founders to support their objectives, develop strategies, and execute solutions.

To learn more about how Taureau Group can help, contact us today.

ANDREW SANNES

Managing Director

Technology & Business Services Lead

312.420.2134

as@taureaugroup.com

Sources: KPMG Q3’21 Report, CapitalIQ, and Pitchbook