Deal Size Premium: Why Acquisitions Can Be Attractive

by Tom Venner

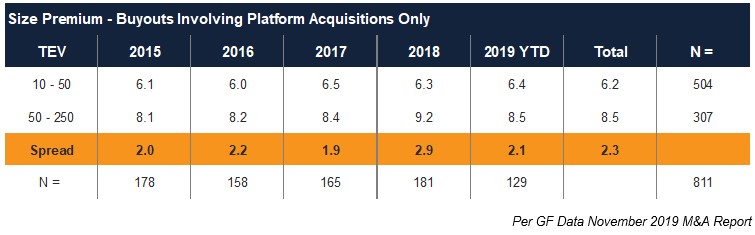

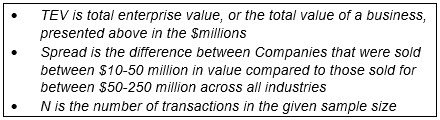

When considering the value of a business, an important and often overlooked component is a “size premium” available to mainly larger businesses. Size premium exists for several reasons, namely amount of infrastructure, customer and product diversification, and institutionalized operations–characteristics more often seen in larger companies. While there are many variables to consider, on average, larger buyouts receive a premium regarding their valuation and respective EBITDA multiples, as evidenced below.

This concept drives significant activity in the marketplace, as strategic buyers look to acquire multiple smaller companies in the same industry. Financial buyers are more inclined to make add-on acquisitions to increase the overall size of their platform companies and realize valuation or multiple arbitrage.

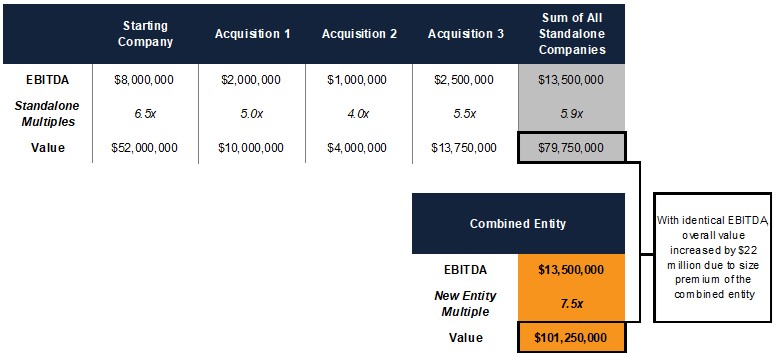

A theoretical example of valuation and multiple arbitrage is outlined in the table below. In this example, a company worth $52 million today invests $28 million into 3 acquisitions, and in doing so (assuming no EBITDA appreciation or synergies), increases total business value to $101 million because of the size premium multiple associated with the larger overall entity.

It is never too early to begin positioning your company for eventual sale. Working with experienced advisors and knowing that a potential buyer may be looking at an arbitrage opportunity allows for negotiating leverage. Or, depending on investment horizons, developing an acquisition strategy could add significant value to a business. Regardless of your objectives, the M&A professionals at Taureau Group can help develop a strategic vision to maximize value.

For more information or to explore any questions you might have regarding this article or mergers and acquisitions, please contact Tom Venner, analyst, at tv@taureaugroup.com or any member of the Taureau Group team at 414-465-5555.