Introduction to Capital Structuring

by Tom Venner

Consider your company’s size, credit profile and willingness to assume risk when determining the best capital structure for your transaction. Many variables will affect which type of financing should be used.

M&A transactions often depend on the availability of sufficient financing options. Capital structure, or the way in which financing is structured for a pending transaction, is important because it directly affects how much buyers are able or willing to pay for an acquisition.

The type and cost of capital needed to structure a transaction is dependent on several factors, including company size and credit profile, among many others. Buyers must carefully weigh financing options to determine the best mix for each transaction. External factors, such as interest rates and macroeconomic factors are also considered.

Buyers choose among available sources of financing based on a variety of factors, including cost of capital, financial profile and speed to close the transaction. Ultimately, the best capital structure is unique to each buyer and can include sources such as debt financing and cash/equity financing.

Debt financing

Debt financing refers to the use of debt to finance an acquisition, either through the issuance of new debt or the use of an existing revolving line of credit. Pitchbook’s 2017 Annual US PE Breakdown report shows debt usage in 2017 was in line with the 10-year average debt percentage of 55% in private equity-backed M&A transactions.

Utilizing debt has tax benefits because interest payments are tax deductible and this increased leverage can also boost a company’s return on investment. Debt is considered cheaper than equity when financing an M&A transaction, though many buyers are constrained on how much debt they are able to incur. A general starting point with obtaining bank financing for lower middle-market transactions less than $25 million is a maximum cash flow leverage ratio of 3x senior debt and 4x total debt.

A simplified definition of cash flow leverage is: a measure of a company’s ability to use its financial resources to pay off debt, which is calculated using a ratio of (interest bearing debt / EBITDA). However, every situation is unique and can certainly impact the availability of leverage. In recent quarters, the amount of available bank financing has been creeping up. In the first quarter of 2018, the average senior debt on M&A transactions of all sizes was 3.4x according to GF Data.

When obtaining debt financing, companies often have multiple options to consider, for example:

- Traditional senior lending. This has the lowest cost, but is most restrictive in terms of lending limits and covenant structures. Borrowing limits are based on the company’s operations, collateral and cash flow, among others. It’s typically provided by local, regional or national banking institutions.

- Asset-based lending (ABL). ABL loans are made based on the collateral put up for the loan with less focus on cash flow, and are typically more expensive than traditional senior lending.

- Mezzanine debt (i.e. subordinated). These are loans made behind senior debt, often without a reliance or lien on collateral. Because mezzanine debt is often not collateralized, it is considered more risky than senior bank debt and is priced higher accordingly.

- Seller financing. The seller in an M&A transaction loans money to the buyer in order to help the financing of an acquisition. The seller receives interest payments on the seller note in return for effectively deferring part of the purchase price to a later date. A seller note is often used when the company’s assets do not provide sufficient collateral for senior financing. Per the Acquiom 2017 M&A Deal Terms Survey, 64% of all M&A deals contain a contingent component (such as a seller note or earnout).

Cash/equity financing

Buyers may also use available cash to fund acquisitions. While cash transactions are less complex and can often be quicker, they do come with an opportunity cost. Therefore, many companies utilize a mix of cash with debt to finance acquisitions.

Equity financing for some buyers can also take the form of its own stock as acquisition currency. Stock can provide the buyer with greater flexibility, as there are no mandatory cash payments, no principal repayments and no covenants on common equity.

Equity investors can be corporations, private equity groups, venture capitalists, or angel investors/individuals. These investors could assume some account of ownership or representation on the board of directors and therefore typically have a say in the operations of the business. One of the most important features of financing acquisitions with equity is the relinquishment of ownership.

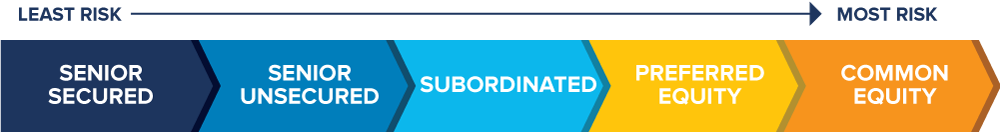

Generally speaking, funding an acquisition with cash or equity is often considered a more expensive form of capital due to having no claim to the company’s assets and lower priority in a liquidation scenario.

Cost of Capital

The cost of capital for privately held businesses varies significantly by capital type, size and risk assumed. This relationship is depicted in the chart below.

Source: Study conducted by Pepperdine University, 2018 Private Capital Market Report

Financing can have a profound impact on the success of a transaction, so choosing the correct capital structure is very important.

For additional insight related to transaction structuring, read these recent Taureau Group articles:

To better understand your options related to financing a transaction, please contact Tom Venner, analyst, at tv@taureaugroup.com, or any member of the Taureau Group team at 414-465-5555.